How to Pay Non-Tax Dues Online Easily!!

Service Code: CMA-601 | Department: Commissionerate of Municipal Administration

Purpose:

The Collection of Non Tax service enables property owners to pay their outstanding non-tax dues to municipal administrations through the e-District portal. This service is designed for:

- Property owners in municipal areas outside Chennai Corporation

- Business establishments with municipal non-tax obligations

- Authorized representatives handling municipal payments

- Residents of various municipal administrations across Tamil Nadu

Required Information:

Mandatory Search Criteria:

- ULB Code (Urban Local Body Code)

- Allotment Number (either New Allotment No. or Old Allotment No.)

Special Requirements:

- Existing Property: Must have a registered property with municipal administration

- DCB Details: System displays month-wise and year-wise outstanding demands

- Cumulative Balance: Shows running total of all outstanding amounts

- Payment Flexibility: Can pay any amount towards total dues

- Multiple ULBs: Service covers various municipal administrations across Tamil Nadu

Step-by-Step Payment Process:

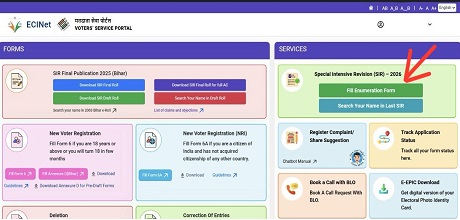

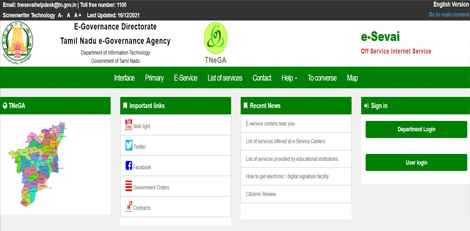

1. Visit the Portal: Login to e-Sevai Tamil Nadu http://tnesevai.tn.gov.in/ portal as Operator

2. Navigate to Service: Click on Services - Commissionerate of Municipal Administration - CMA-601 Collection of Non Tax

3. Click Proceed: On the service description page, click Proceed button

4. Enter Property Details:

- Select ULB Code (Mandatory - selects specific municipality)

- Enter either New Allotment No. or Old Allotment No. (Mandatory)

- Click Search

5. Verify Property Details: System displays:

- Owner Name and Address

- Property Type (e.g., Building)

- Property Number and Ward Number

- ULB/Municipality Name

6. Review DCB Details: System shows detailed breakdown:

- Period-wise demands (monthly and yearly)

- Service Tax amounts

- Tax Demand Amount (original due)

- Tax Collected Amount (already paid)

- Total Balance Amount (outstanding per period)

- Cumulative Balance Amount (running total)

7. Make Payment:

- Enter Amount To Be Paid (can be partial or full amount)

- Click Make Payment

8. Download Receipt: After successful payment:

- Click Get Receipt to download payment receipt

- Save/print the receipt for your records

Alternative CSC Centre Method:

Property owners may also pay non-tax dues through any Common Service Centre (CSC) where trained operators assist with:

- ULB code and allotment number verification

/>- DCB details explanation

- Payment amount calculation

- Payment processing

- Receipt download and printing

After Payment:

- Instant Receipt: Payment receipt available immediately

- Digital Record: Payment recorded in municipal database

- Proof of Payment: Downloadable receipt serves as payment proof

- No Physical Visit: Entire process completed online

Important Notes:

- Mandatory Fields: ULB Code and Allotment Number are both required for search

- Multiple Municipalities: Service covers various ULBs across Tamil Nadu (not just Chennai)

- Detailed Breakdown: System shows period-wise DCB details with cumulative totals

- Flexible Payment: Can pay any amount towards total outstanding balance

- Receipt Details: Includes property information, payment breakdown, and transaction details

- Property Types: Covers various property types including buildings, commercial establishments, etc.

- Historical Data: Shows demands from previous years with complete payment history

- Commissionerate of Municipal Administration: Service covers multiple municipal administrations across the state

Apply Online: http://tnesevai.tn.gov.in/

Assistance: Visit your nearest e-Sevai / CSC Centre

This guide is based on the Commissionerate of Municipal Administration User Manual. Government of Tamil Nadu, 2016.