Tamilnad Mercantile Bank : Reviewed Financial Results For the Quarter Ended - Dec 20

Posted on: 02/Feb/2021 9:39:18 PM

Tamilnad Mercantile Bank Limited (TMB) one of the premier Old Private Sector Scheduled Commercial Banks, having Head Quarters in Thoothukudi has a long cherished history of 99+ years of successful banking and celebrating its Centenary Year with strong fundamentals and a record of continuous profit making in the industry.

TMB having pan India presence with 509 branches and 12 Regional Offices across 16 states and 4 Union Territories is serving more than 4.80 million delighted customers. The bank is having 1162 ATMs, 45 e-lobbies and 224 Nos. of Cash Recycler Machines.

The Board of Directors of the Bank adopted the reviewed results of the Bank for the quarter ended 31.12.2020 in their meeting held at Chennai on 02.02.2021. In the presence of Board of Directors, Shri K.V.Rama Moorthy, Managing Director and CEO of the bank has announced the Reviewed Financial Results for the quarter ended Dec� 2020. Chief Financial Officer, Vice President and General Managers of the Bank were also present at the event.

Quarterly Performance Q3 2020-21 vis-�-vis Q3 2019-20 (Standalone for Q3)

- Net Profit stood at ₹180.81 Crores (PY ₹92.42 Crores) with a growth of 95.64%.

- Operating Profit stood at ₹349.82 Crores (PY ₹255.87 Crores) with a growth of 36.72%. Total income stood at ₹1083.45 Crores (PY ₹998.91 Crores) with a growth of 8.46%.

- Net Interest income stood at ₹428.73 Crores (PY ₹338.72 Crores) with a growth of 26.57%.

Quarterly Performance Q3 vis-�-vis Q2 of 2020-21

- Q3 Net Profit stood at ₹180.81 Crores as against Rs.120.78 Crores in Q2 by registering a growth of 49.70%.

- Operating Profit stood at ₹349.82 Crores as against Rs.258.94 Crores in Q2 by registering a growth of 35.10%.

- Total income stood at ₹1,083.45 Crores as against Rs.1,030.71 Crores in Q2 by registering a growth of 5.11%.

- Net interest income stood at ₹428.73 Crores as against Rs.371.00 Crores in Q2 by registering a growth of 15.56%.

The Bank is having an additional Standard Assets Provision of Rs.150 Crores plus Rs.3.80 Crores for 90 DPD accounts in respect of COVID stressed accounts in line with Supreme

Court directives for standstill clause.

Credit to Priority & MSME Sector:

- The Bank has been giving continued thrust on advances to Priority Sectors like Agriculture, MSME, Education, Housing etc. constituting 76.57% of its Adjusted Net Bank Credit (ANBC), above the regulatory requirement of 40%.

- The Advances to Priority sector has increased to ₹21163.85 Crores (PY ₹17866.38 Crores) with a growth of 18.46%.

- The Bank�s Advances to Agriculture sector stood at ₹7,812.54 Croreses. The Advances to Agriculture Sector constitute 25.86% of total advances, above the regulatory requirement of 18%.

- Credit to MSME sector has increased to ₹11,893.72 Crores (PY ₹10,362.56 Crores) with a growth of 14.78%.

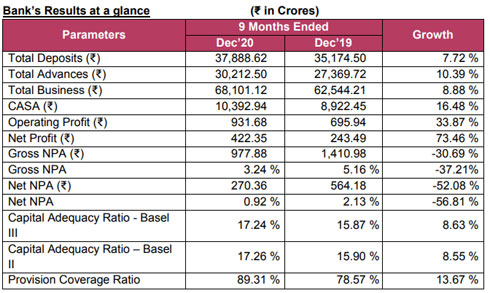

Y-O-Y Performance:

- The Bank�s deposits has increased to ₹37,888.62 crores (PY ₹35,174.49 crores) with a growth of 7.72% whereas the average growth was 9.48%.

- The Bank�s CASA position has increased to ₹10,392.94 crores with a growth of 16.48% and the average growth was 18.58%.

- The advance level of the Bank has increased to ₹30,212.50 crores with a growth of 10.39% and the average growth was 9.85%.

- Agriculture advances increased to ₹7812 crores (PY ₹6558 crores) with a growth of 19.11%.

- Retail advances portfolio increased to ₹6133 crores (PY ₹5103 crores) with a growth of 20.18%

- MSME advances increased to ₹11894 crores (PY ₹10363 crores) with a growth of 14.77%

- Non-interest income stood at ₹448.16 crores (PY ₹354.54 crores)

- Operating expenses stood at ₹678.80 crores (PY ₹632.01 crores)

- The Operating Profit is at ₹931.68 Crores (PY ₹695.94 Crores)

- The Net Interest Income (NII) has increased to ₹1,162.32 Crores (PY ₹ 973.41 Crores)

- The Bank�s Net worth increased to ₹4,404 crores (PY ₹3,817 crores) with absolute rise of ₹587 crores registering a growth of 15.36%

- Interest Income stood at ₹2,732.77 Crores with an increase from previous year figure of ₹2,571.39 Crores (Increase by ₹161.38 Crores @ 6.28%)

- The Interest Expenditure has decreased from the level of ₹1597.98 Crores to ₹1,570.45 Crores (decrease by ₹27.53 Crores @ -1.72%).

- The Gross NPA as a percentage to total advances reduced to 3.24% and Net NPA reduced to 0.92%

- The Capital Adequacy Ratio (Basel III) of the bank increased to 17.24% (PY 15.87%)

- The Capital Adequacy Ratio (Basel II) of the bank increased to 17.26% (PY 15.90%)

- Provision Coverage Ratio of the Bank stands increased to 89.31% (PY 78.57%)

Network Expansion upto quarter ended December 2020:

- 55 new cash recycler machines were installed at Branches / ATM Centers, taking the tally to 224.

- 6 new ATMs were added this year & the total number of ATMs stood at 1162.

- 14 new E-lobbies were opened this year with a total number E-lobbies stood at 45.

- TMB inaugurated Robotic operation as fully automated Currency Chest at Chennai and Thoothukudi � Pudukottai

- Bank�s website was revamped with attractive features user friendly

- Introduced Whatsapp Banking

- Introduced Mobile application, DigiLobby for non-financial services

- Integration with Public Fund Management System (PFMS) to handle transactions in Government accounts

New Initiatives Contemplated:

- Finacle 10x Migration

- Introducing New Enhanced Integrated Mobile Banking

- Centralized Account Opening solution

- Onboarding Customers using Video K KYC

- Customer Relationship Management Solution � CRM

- Introducing Call Centre operations

Business Targets for the Financial Year 2020-21:

- Total Business to cross ₹72,500 Crores.

- Total Deposits to cross ₹40,500 Crores.

- Total Advances to cross ₹32,000 Crores.

- Total CASA to cross ₹10,800 Crores

- Achieve a Net Profit of ₹480 Crores.

Post your requirement - We will connect with the right vendor or service provider