No. of views : (2114)

Use governments UPI app for cashless transactions

Posted on: 27/Dec/2016 11:22:00 AM

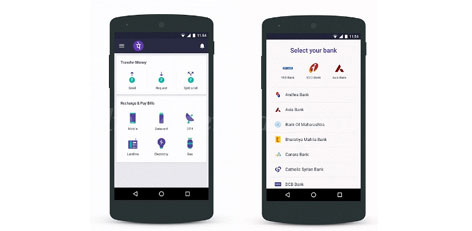

Unified Payment Interface (UPI) promises universal electronic transactions leading to a cashless society. This was introduced by the government earlier this year.

The app functions on the same infrastructure as the Immediate Payment Services (IMPS) that you can use on your smartphones.

UPI is a payment system that allows money to be transferred between any two bank accounts using a smartphone.

Users need to create a Virtual Payment Address and link it to a bank account, which then acts as their financial address.

Sending money using the UPI app is as easy as sending a message, since users don�t need to remember the beneficiary�s account details or their own net banking ID and password.

The service is instant and available round the clock, even on public and bank holidays.

Currently, the per transaction cap is Rs 1,00,000. But this may change from time to time, as it is subject to the UPI guidelines.

Post your requirement - We will connect with the right vendor or service provider