Good Financial Habits - The First Step Towards Wealth Creation

It is often said that our habits define our destiny. This holds true in finance as well 45% to 90% of our behavior is shaped by habits, controlled largely by the subconscious mind. When it comes to wealth creation and investments, building the right financial habits can be the real game changer.

Why Financial Habits Matter in Investment Success

Strong financial habits form the backbone of long-term wealth. Without them, it becomes difficult to save, invest, or manage risks effectively. Individuals who practice disciplined money habits are not only better positioned to create wealth but also avoid falling into heavy debt traps.

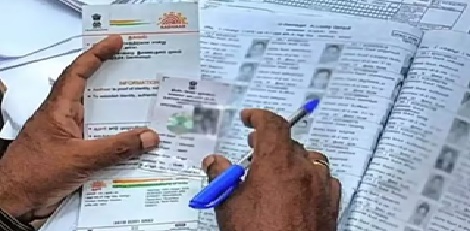

Documentation – The Investor’s Golden Habit

One of the most powerful yet underrated financial habits is documentation. From invoices and bills to receipts and contracts, maintaining proper records physically or digitally creates a structured financial life. Successful investors often credit their discipline in documentation as a foundation for making smarter, data-driven decisions.

How Documentation Supports Investment Growth

Clear Expense Tracking: Helps identify savings potential, which can be redirected towards investments.

Tax Benefits: Organized records simplify filing returns and maximize eligible tax deductions vital for investors.

Warranty & Claims: Proper filing ensures that assets are protected, preventing unnecessary expenses.

Strategic Planning: A clear picture of cash flow and expenditure enables better allocation to stocks, mutual funds, or real estate.

Family & Legacy: Maintains transparency, ensuring that family members understand financial structures in case of emergencies.

Building a System for Wealth Efficiency

Setting up a dedicated investment file or digital portfolio tracker makes managing money easier and more transparent. Whether it’s household bills, SIP confirmations, property deeds, or insurance policies, structured documentation ensures that every rupee is accounted for. This habit enhances efficiency, reduces waste, and maximizes opportunities for wealth building.

Key Takeaway for Investors

Wealth is not built overnight it is the result of consistent habits. By cultivating the practice of documenting and organizing financial transactions, individuals can gain clarity, reduce risks, and channel savings into high-value investments.

As the saying goes: “You first build your habits, then your habits build you.” For aspiring investors, the habit of financial documentation is not just about record-keeping it is about laying the foundation for long-term prosperity.