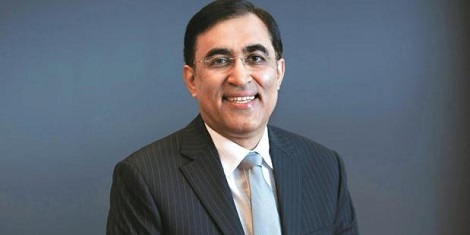

Monetary Policy quote from Mr. Rajiv Sabharwal, MD and CEO, Tata Capital

Posted on: 04/Apr/2019 3:40:57 PM - No. of views : (3444)

Quote from Mr. Rajiv Sabharwal, MD and CEO, Tata Capital on the monetary policy.

�In the first monetary policy of FY 19 - 20, RBI as expected delivered a 25bps rate cut in the Repo Rate. With the RBI�s recent long-term forex swap tool and OMO�s infusing liquidity, credit growth will continue to gain momentum. Further, India�s bond market will attract foreign inflows and boost market sentiments. With Inflation under control and signs of a stronger Rupee supports RBI�s neutral stance, which will fuel growth in the economy. The RBI may pause and closely watch for global growth cues and impact of the monsoon before any further intervention.�