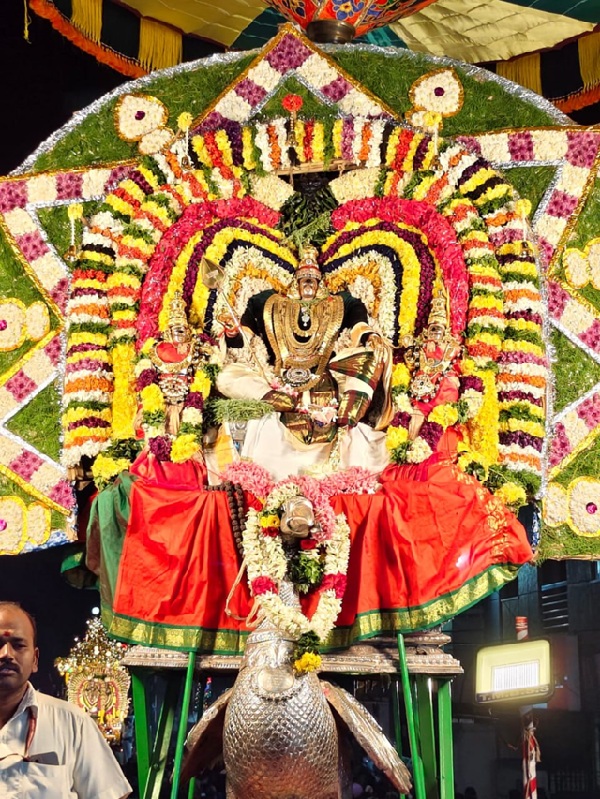

Tiruvannamalai Thiru Karthikai Deepam Brahmotsavam - Divine 4th Night Procession

Posted on: 28/Nov/2025 11:14:46 AM

The 4th Night of the Tiruvannamalai Thiru Karthikai Deepam Brahmotsavam was celebrated with grand silver vahanam processions. Vinayagar graced the Silver Mooshika Vahanam, Murugar with Valli and Deivanai appeared on the Silver Peacock, Periyanayagar on the Karpavirutcham Vahanam, Parasakthi on the Silver Kamadhenu, and Sandikeswarar on the Silver Rishabam, blessing thousands of devotees.